Wingtech Technology Completed the Placement at Premium of 5.8 billion CNY

On July 28, Wingtech Technology issued an announcement that the issuance of shares and the payment of cash to acquire the remaining equity of Nexperia Semiconductor and the raising of supporting funds have been completed, of which the high-profile 5.8 billion fixed increase project has been completed at a premium.

The issuance price of new shares in the asset purchase part of this issuance is 90.43 CNY/share, and the issuance price of the new shares in the part of the issuance of shares to raise supporting funds is 130.10 CNY/share. The total number of new shares is 112,962,327 shares, and the total share capital of the listed company Will increase to 1,244,937,731 shares.

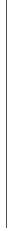

According to the pricing of this transaction and the stock issuance price calculation, the number of shares and cash consideration that the listed company will issue to the counterparty in this transaction are as below:

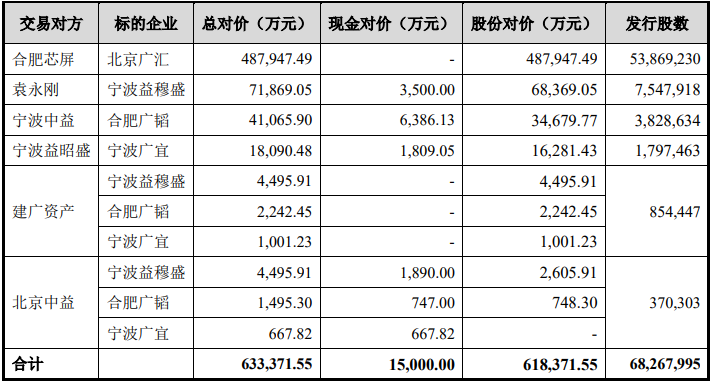

The pricing base date for this supporting issuance is the first day of the issuance period (July 9, 2020), and the reserve price is 98.21 CNY/share, which is not less than 80% of the average stock trading price in the 20 trading days before the pricing base date. However, the popularity of the project has exceeded expectations. In the list of supporting financing subions, like Gyasset, Yangtze River Delta (Shanghai) Industrial Innovation Equity Investment Fund, China International Capital Corporation Hong Kong Asset Management Co., Ltd., Foresight Fund, The Greater Bay Area Industry Finance Investment, Well-known investors such as Weidong Ge, UBS, JPMORGAN, etc., eventually 16 issuers subscribed at a substantial premium of 130.10 CNY/share.

The final issuance target, the number of shares to be subscribed, the amount of allotment and the specific situation of the restriction period are as follows:

Wingtech has been vigorously developing high-quality customers in recent years. Its shipments, operating income and net profit have maintained robust growth. In the first half of 2020, due to the rapid development of the company's performance, the net profit attributable to shareholders of listed companies is expected to be between 1.6 billion CNY and 1.8 billion CNY, an increase of 715.50% to 817.44% year-on-year.

Media Contact

Ms.Zhang,PR manager

![关于闻泰[图片]](/static/LM_Img/关于我们_小图-120230320102917.jpg)

![新闻资讯[图片]](/static/LM_Img/新闻资讯2017032011413820171023023641.jpg)

![服务领域[图片]](/static/LM_Img/fuwu2017032011004120171023024342.jpg)

![关于闻泰[图片]](/static/LM_Img/投资者关系20170320110238.jpg)

![人才发展[图片]](/static/LM_Img/人才发展20170320112039.jpg)

![联系我们[图片]](/static/LM_Img/联系我们20170320114037.jpg)